When I was growing up (well, okay, I’m still in that process), my grandmother

always had words of wisdom, even if that wisdom was not always of the warm

and fuzzy variety. But one warmish thing I recall her saying in times of

turmoil and bad happenings was, “Things will change lickety split, don’t

worry.”

It was quite a few years before I realized lickety

split meant fast. That phrase came to mind today as I was

researching Billionaire Dan Gilbert. We’ve blogged a bit about Quicken Loans

(and Rocket

Mortgage) and Jeff Bezos of

Amazon. Today, we’ll focus some on Dan Gilbert, who happens to own

Quicken. He is one lickety split kind of guy, in both good and bad

ways.

On May 26, Dan Gilbert suffered a stroke. No, no, this is not an obituary (he

survived). But I certainly believe that day changed his perspective, life,

and goals--lickety split. What follows here is a compilation of some of the

professional things Dan has done in his life (as I had NO idea) with a

focus, of course, on his mortgage endeavors.

First some fun facts:

Dan Gilbert and company own over 100 buildings in Detroit, many of which have been totally renovated.

He owns many Detroit skyscrapers — the First National, One Woodward, 1001 Woodward, and others where about 17,000 workers are employed.

Under his Rock Ventures umbrella, Gilbert oversees Quicken, Bedrock Properties and Dictionary.com.

Then there is Rocket Fiber, which works at providing Detroit’s fastest home and business internet service, and StockX, allegedly the first online consumer "stock market of things" for high-demand products like expensive sneakers. Yes, it is a lickety split company.

Quicken originally started in 1985 as Rock Financial, co-founded by Gilbert. It was then sold it to Intuit for $532 million in 1999, but bought it back 3 years later for $64 million.

Bedrock Properties is planning Detroit’s tallest building on a long-vacant site downtown.

He currently owns the Cleveland Cavaliers.

Gilbert maintains gambling interests via ownership of Horseshoe Casino in Baltimore, Jack Cincinnati Casino, and Jack Cleveland Casino, and others.

Dan Gilbert hopes to bring major league soccer to downtown Detroit.

Dan Gilbert was born Jan. 17, 1962, in Detroit, married Jennifer Gilbert, and has four sons and one daughter. In the category of NOT fun, Gilbert's son Nick has a rare genetic disorder called neurofibromatosis, which causes tumors to grow throughout his body. Dan and Jennifer Gilbert founded the Gilbert Family Foundation to help fight for a cure.

Possibly also not fun for Dan, is this article in Cavalier’s Nation, “NBA Commissioner Comments on Dan Gilbert’s Condition and Ability to Continue as Cavs Owner.”

And on 6/14/19 as reported in the New York Times, “Quicken Loans to Pay $32.5M to Settle Lawsuit Over Bad Loans”

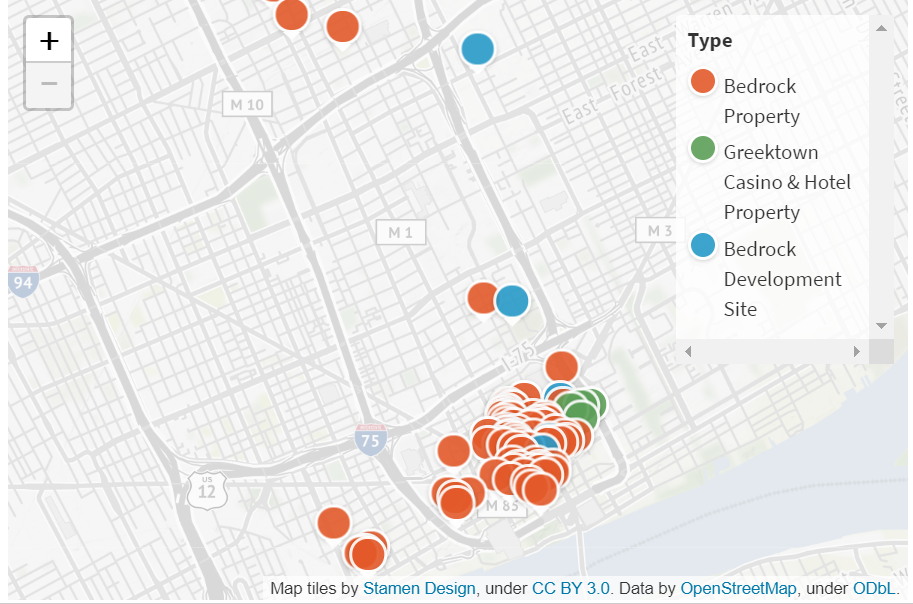

Lickety split, let’s get back to the fun stuff. Here’s a map of just his Detroit holdings from the Detroit Metro Times.

And there is a colorful list of even more of what he owns, in detail, in The Rock

Family of Companies.

Getting focused, let’s discuss Quicken.

In short, Quicken Loans Inc. is the nation’s largest online retail mortgage lender and the first or second largest retail mortgage lender. That depends on the ranking company, how badly Wells has gotten slammed in the media lately, and whether or not Quicken’s volume is combined with Rocket Mortgage.

Here’s more:

Nearly half a trillion dollars of mortgage volume across all 50 states from 2013 through 2018 was closed by Quicken.

Per the link above, “Quicken Loans ranked highest in the country for customer satisfaction for primary mortgage origination by J.D. Power for the past nine consecutive years, 2010 – 2018, and also ranked highest in the country for customer satisfaction among all mortgage servicers the past five consecutive years, 2014 – 2018.”

It has also made the list of the “100 Best Companies to Work For” for the past 15 years.

Also from the link above, “The company was also named the #1 place to work in technology in 2017 by Computerworld magazine’s “100 Best Places to Work in IT,” a recognition it has received 8 times in the past 12 years. In addition, Essence Magazine named Quicken Loans “#1 Place to Work in the Country for African Americans.”

Most remarkable (to me), is that Quicken was, as stated, founded in 1985 and it still exists. Truly, not many other top lenders can make that statement. I’ve been with 3 top 10 lenders which no longer exist. 2007 and 2008 happened and, lickety split, we said goodbye to so many mortgage companies, but not Quicken.

Of course, Life in the Fast Lane, is never perfect. Just a month before his stroke, the Detroit Free Press reported, “Dan Gilbert defends Quicken Loans over 'junk' bond rating.”

Let's digress a tad. What IS a junk bond? See a great video explanation from

our friends at Investopedia

(scroll down after clicking). I also liked these two included

classifications of junk bonds.

- “Fallen Angels – This is a bond that was once investment grade but has since been reduced to junk-bond status because of the issuing company's poor credit quality.

- Rising Stars – The opposite of a fallen angel, this is a bond with a rating that has been increased because of the issuing company's improving credit quality. A rising star may still be a junk bond, but it's on its way to being investment quality.”

And then the summary:

“Despite their name, junk bonds can be valuable investments for informed investors, but their potential high returns come with the potential for high risk.”

To all numerical evaluations, Dan Gilbert’s empire looks very little like

“junk.” But what of Dan Gilbert himself? Numerous accounts say his road to

physical recovery ”will take time.'' Here’s a quote from the Detroit

News.

"He’s on the road to recovery," Quicken Loans CEO Jay Farner told CNBC's

Jim Cramer on "Mad Money" on Wednesday. "If there’s a guy out there who

has the passion and energy to accelerate whatever timelines they have

for him, it’s Dan."

Asked for an update, Quicken Loans referred to a statement released more

than a week ago in which Farner said he "maintains his strong sense of

humor and focus on constant improvement" and that his "recovery is a

process that will take time."

That sure sounds like a lickety split recovery is in process. It also

highlighted Dan’s sense of humor. Ironically, Dan Gilbert himself is a lover

of practical jokes, even though he may not be that great at them. The big

lead printed,

“A lover of practical jokes, Gilbert once wanted to dummy up a fake news

release that the Cavs were signing Dennis Rodman to a 10-day contract

and put it out on April Fools’ Day; he was talked out of that one. After

a playoff victory over the Washington Wizards 10 years ago, Gilbert had

a remote-controlled fart machine installed under coach Mike Brown’s

seat. When Brown went up to the dais for the postgame news conference,

Gilbert stood in the back and worked the controls. Brown was flummoxed —

although the microphones didn’t pick up the sounds.”

Okay, lets see if we can produce some better humor lickety split. Exercising

that has been sorely lacking so far in this blog.

- My buyer told me that he lived in the same house for 10 years. When I checked, I found out he'd still be there today if the Governor hadn't pardoned him.

- Realtor sign--We have "lots" to be thankful for.

- Realtor: first you folks tell me what you can afford, then we'll have a good laugh and go on from there.

- The dream of the older generation was to pay off a mortgage. The dream of today's young families is to get one.

- Did you hear about Robin Hood's house? It has a little John

Read More Here: