AMAZON PRIME … RATE?

Being as I am, this cracked me up. I had been reading about the future Amazon mortgage (or whatever snappy name it eventually takes). Therefore, I searched “Amazon Mortgage.” NOT surprisingly, the very first link to appear that day was Amazon.com:mortgage. (This is no longer the case, by the way.) But when I clicked that link, this is what I got:

What? Nothing about “Coming Soon” or “Under Development?” I’m appalled, and had such high expectations. But, perhaps I was being prematurely judgemental. No. Not until several links down did anything remotely related to Amazon Mortgage appear. And here it was:

Amazon hiring head of newly-formed mortgage lending division

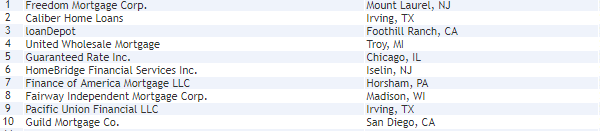

My first thought, of course, was, “Where do I send my resume?” Then I read this: “We can say that if you look at the top 10 HMDA lenders and pick out the nonbanks, that’s where Amazon is recruiting their talent.” Well, dang. So let’s see who those people might be.

The Scotsman Guide lists these 2016 lenders as the top:

I personally know the top people at 4 or 5 of those companies. I hope a few of them get named and wish them well. I also hope they remember my phone number. Setting up an Amazon mortgage company sounds like great fun to me! (Yes, I’m still crazy after all these years.)

But hold on a minute.

A Quick Amazon Mortgage?

My continuing quest for Amazon Mortgage information resulted in this gem, again in Housing Wire:

Quicken Loans brings Rocket Mortgage to Amazon Prime homeowners

If Rocket Mortgage is already at Amazon, then why is Amazon Mortgage needed at all, you may query. Keep reading.

Check the comments at 1:26 by Frank Garay and Brian Stevens here -- is Amazon the next big BANK??? Makes sense (and I loved the line about Dan Gilbert’s weath not being the same scale as Jeff Bezos’s wealth … oh my).

You Can Bank on Them

Amazon is already far along the path to becoming a financial services provider. Alexa can make your Quicken Loans Rocket Mortgage payment for you. And if you have Amazon Echo, Echo Dot, Echo Show, the Amazon mobile app, or another Alexa-enabled device, you can now check mortgage rates and review balances using one of them!

And then American Banker headlined, “How Amazon is shaking up financial services.” Comments related to mortgages in the body of the article were limited to:

“And several recent developments suggest that Amazon has substantially broader ambitions. Checking accounts, small business credit cards and even mortgages all appear to be in the company’s sights.”

But clicking on the included slideshow displayed information about Amazon and:

Small business lending -- reportedly, in nearly secret conjunction with Bank of America, Amazon closed over $3 Billion in loans to small businesses in one year.

Amazon Reload -- where Prime members can get 2% cash back on money spent from a gift card tied to their bank account.

Amazon Cash -- which allows customers to load cash into their account, download a barcode, and use that at stores, no fee.

Whats next? Most likely checking accounts, small business credit cards, and, yes, mortgages will be here very soon.

All of this sounds great. And Alexa is already being used as a tool for mortgage seekers.

In, “Amazon’s Alexa can now search for mortgages” via UK’s Mortgage Strategy, we learn that Alexa can scour over 10,000 loans to find the right product … provide the name and phone number of local mortgage brokers after getting a zip code from the user … send the top fixed, variable and tracker mortgage results ...

But before we delve further, let’s determine how well Amazon truly delivers the, err, goods.

As Good As It Gets?

According to MotleyFool.com, Amazon is delivering (pun intended) just fine.

While Amazon.com is one of the most successful companies of the past several decades, and shares have multiplied an astounding 710 times since 1997, it could very well be in the early part of its growth potential.

At least one in every 10 Americans has an Amazon Prime membership where they spend an average of $1,200 annually.

Prime Now, the company's on-call local delivery service, is expected to push e-commerce sales further as the service expands; it is still currently only available in select markets.

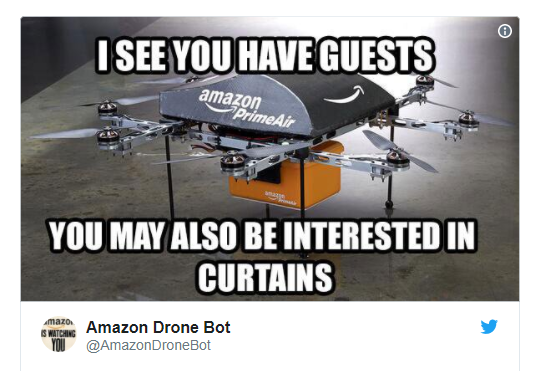

The company's drone program aims to deliver items in 30 minutes. So far, one experimental delivery in Miami took less than 10 minutes.

Amazon has a separate cloud-division which generates revenue higher than its four nearest competitors combined. Amazon's engineering lab in California (A9) was allegedly originally built to unseat Google in search advertising.

In 1998, Amazon’s Jeff Bezos gave Google co-founders Larry Page and Sergey Brin a $250,000 check to fund their start-up. Bezos hasn't commented on whether he still owns shares, but estimates are that he does and that his investment has an extraordinary ROI.

Amazon owns shoe retailer Zappos, a pioneer in corporate culture.

Amazon uses robots for order fulfillment. Therefore, it bought robotics and automation provider Kiva Systems for $775 in 2012. Amazon has a fleet of well over 15,000 robots.

Stop reading for one second. Amazon just shipped 35 items in that time frame.

Amazon shipping is so efficient it can ship up to 1.5 million items per day from one fulfillment center . The company just purchased a fleet of trailers to ship between fulfillment centers and is working with Boeing to lease up to 20 767s.

Click this link, relentless.com

So then, yes, Amazon is already excellent and quite likely getting better. Perhaps it will be the company to reinvent the mortgage business. And since it appears it is simply too early to report specific details about AmazonMortgage.com, I thought it might be nice to use what we already know about Amazon.com and arrogantly create a few parts of their mortgage company for them. 🙂

Repurposing the Well Purposed

One of the top rated aspects of Amazon.com is SELECTION. Americans will expect nothing less from AmazonMortgage.com. That means every mortgage product that exists will need to be offered. Stealing a list from nerdwallet.com, expect AmazonMortgage.com to purchase:

Rocket Mortgage by Quicken Loans

And let’s toss in ratezip.com, if only for their excellent blog features! (joking!!!)

And, yes, we noticed some correlations between potential new leaders of AmazonMortgage.com and the companies on this list above.

Moving on to translating existing aspects of Amazon to mortgage lending, let’s focus on just a few more (in addition to Alexa, mentioned above). Clearly, my favorite aspect of Amazon is AMAZON PRIME. It supplies me with immediate gratification and no shipping costs. (Yes, of course I forget I paid that steep annual fee months ago).

How do we duplicate that in the mortgage world? How about if all borrowers pay a related steep annual fee and Amazon automatically refinances them with no closing costs, whenever applicable? That works!

ECHO and ALEXA - Why not further adapt Echo and Alexa for mortgage use. Program algorithms to respond to, “Based on market conditions, how much equity do I have in my home? … How much will it cost me to renovate my kitchen and at what interest rate? … What is my mortgage payoff amount? … How do I get my lowlife ex-boyfriend off my mortgage?” We can go on and on!

What’s It All About Amzie?

Let’s make it simple. According to, “What Amazon Gets About Customers (That You Probably Don't)” in INC.com, here’s what customers love about Amazon. Before you ask, “Is that what matters?,” let’s let Jeff Bezos answer.

"It used to be that if you made a customer happy, they would tell five friends. Now, with the megaphone of the internet, whether online customer reviews or social media, they can tell 5,000 friends."

So, yes, that IS what it's all about because that’s what generates sales. It is still and always will be all about the money, honey.

And what exactly does Amazon “get”?

“1. Make sure the customer is happy from start to end.

2. Survey

customers and address any hiccups.

3. Make highly personalized

Amazon-style recommendations.

4. Keep an eye on review sites and

address all complaints.

5. Be customer-obsessed.”

I don’t know about you, but in my humble opinion, the mortgage industry would benefit from “getting it” more like that.

Ready, Fire, Aim!

Naturally, then, because it is ginormous and at the top, Amazon is a huge target. Lately, it has taken its share of blame for all things “bad” financially. Review:

Stock Market Drops As Trump Tweets About Amazon, DACA - and -

Dow drops 459 points as Amazon tumbles, trade war fears rise - and my personal favorite (as I have difficulty attempted to fathom this kind of personal net worth … for now, ha)

Jeff Bezos' net worth drops by $16B

But then:

Wall Street to Trump: No trade wars. And lay off Amazon

Most attribute this targeting more likely to be related to the fact that Jeff Bezos owns the Washington Post, which is generally not a fan of President Donald. What else does the current Richest Man own?

Source: Market Watch

Holy moses! I once had fifteen managers directly reporting to me and thought that was a lot! So he has around thirty COMPANIES? Forget about his money, I want his brain. But since I don't have that at the moment, let’s focus on and end with something my brain can handle -- a few Amazon related funnies….

See Also:

- “Will you get your next mortgage from Amazon?” Bankrate 3/30/18

- “On-demand real estate agents are just an app away” The Mortgage Reports 4/11/18

- “5 Amazon services that could be game-changers” WSBTV 3/19/18