Rocket Mortgage is the mortgage application that forever changed the way home loans are obtained.

Designed to let borrowers handle all aspects of the loan application process themselves, Rocket Mortgage by Quicken Loans is perfect for those who like being in control and setting their own pace.

Pros:

Cons:

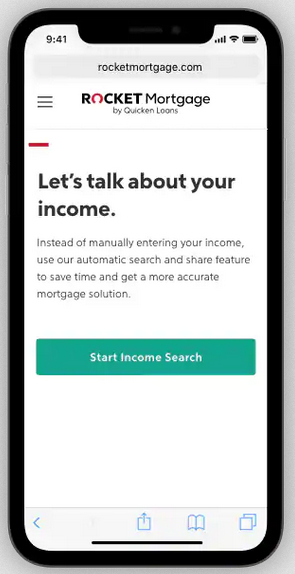

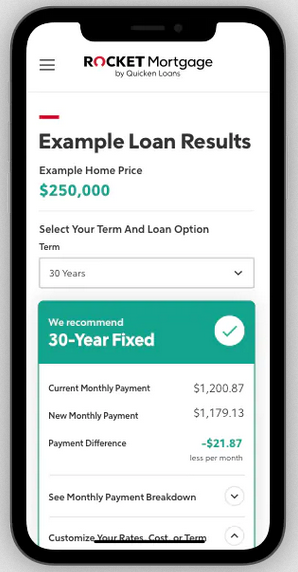

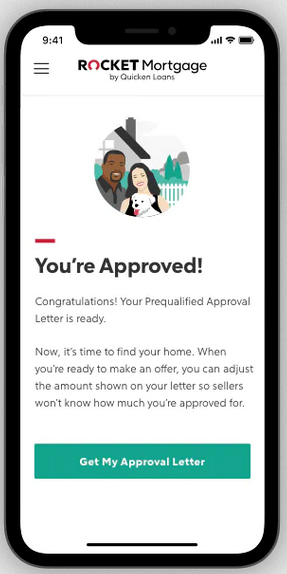

Push Button, Get Mortgage. That’s the slogan for Rocket Mortgage, an online interface and app by Quicken Loans. By using either the app or the online form, potential borrowers can view offers that are customized to suit their needs. The application is easy and generally only takes about a half hour to complete. Borrowers can view today’s interest rates and see if they’re approved to purchase or refinance a home. Borrowers can even automatically share financial information, such as bank statements, with Quicken Loans, which can make the mortgage process faster and more accurate.

Rocket Mortgage offers conventional, FHA, VA and jumbo loans, but does not offer Home Equity Loans or Home Equity Lines of Credit (HELOCs). Instead, borrowers can apply for a cash-out refinance, which Rocket Mortgage does offer and which may be an alternative to a home equity loan, as both allow you to utilize funds for personal reasons, such as renovating, going on vacation, or paying bills. They also don’t offer construction loans or loans for mobile or manufactured homes. Some of Rocket Mortgage’s affiliated or sister companies may be able to help if you’re looking for a product that Rocket Mortgage doesn’t offer. For example, Rocket Loans has personal loans, and One Reverse Mortgage offers reverse mortgages.

As with many online interfaces, you may be wondering how secure Rocket Mortgage really is. Quicken Loans has implemented multiple security measures to make sure that customer information is kept safe. On its website, Rocket Mortgage announces that it has bank-level encryption, industry-leading privacy guidelines, and 24/7 security monitoring. Not only are they helping to make the mortgage process easier, they’re also keeping it safe!

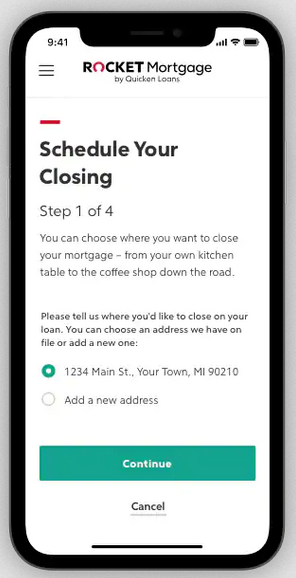

The great thing about applying for a mortgage online is that you can set your own pace and work on it whenever it suits your own schedule. It also helps make the mortgage process even faster. Rocket Mortgage can download financial and asset information directly from most banks and financial institutions (about 98% of banks/financial institutions in the U.S.), saving you from the hassle of getting and supplying that paperwork yourself. If you prefer to meet and discuss your mortgage options in-person, Rocket Mortgage may not be the best for you. While they offer loans in all 50 states, Rocket Mortgage by Quicken Loans is entirely online, and their offices are not open to customers. However, you can still get personalized help from real people, either through online chat, email, or phone. If you’re not quite ready to purchase a home or refinance a mortgage, but are still curious about learning more information, you can check out Rocket Mortgage’s Affordability Calculator or Refinance Calculator, or talk to one of their loan experts for more information.

While Rocket Mortgage is designed to let borrowers go though the mortgage process easily and without talking to an actual human unless they want to, this is not always the case. In certain situations, borrowers still need to talk to loan originators or loan experts in order to move forward. If you are planning on having a cosigner or are self-employed, chances are you will have to talk with a loan expert either by phone or through online chat before being able to move forward.

If you have any questions or need any help with Rocket Mortgage, or if you want to provide feedback, you can easily call a customer service representative, chat with someone on their online chat feature, or use their survey to let them know of your opinion. If you love technology and need to purchase a home or refinance a mortgage, then Rocket Mortgage may be right for you.

This bank profile is not an endorsement or advertisement for the bank's products and services. RateZip is an independent publisher of bank information.