I often takes notes while on conference calls or in seminars by using a sort of self created shorthand (that I often am unable to decipher later). One understandable yet perplexing aspect of that shorthand is my use of FU. Yes, of course I mean Follow Up, referring to something I have been assigned, or a topic for which I need more information. But for a brief nanosecond until it “registers,” I wonder who I am cursing out or why I am swearing at myself. Anyway …

Ideally, all of you brilliant readers dive into every blog, retain all information, stay abreast of the topic du jour and, as a result, serve as the resident expert in mortgage discussions internationally. The reality is probably closer to you skimming the blogs, focusing on the jokes and moving on. So I shall do some in depth follow up on your behalf. In other words, I will now endeavor to answer your question (okay, what should be your question), ”What happened with …?”

The Equifax Fiasco

The debacle continues. We’re not sure who is in cahoots with whom in the epic mess up, but it remains a mess and even got a little messier.

But surely all those previously adversely affected by Equifax are all set now, right? Well, maybe not. Forbes recently reported that Equifax, which had admitted to potentially ruining the credit of over 100 million people, was adding an additional 2.4 million to the data breach, via hacking of their name and partial driver‘s license. One more oops and the hits keep coming, but not from a few good men.

As is nearly always the case, though, creative entrepreneurs, enterprises or crooks find ways to capitalize on disaster. For example, Equifax competitor Experian was all over the formerly unknown “Dark Web” intrigue (where the Equifax hackers allegedly dumped all of your personal data) via a TV ad promoting their Dark Web Identity Protection service.

Wow! How can they do that? They must be tech geniuses! No, wait, you can do it yourself. TechAdvisor tells you how right here.

“Technically, this is not a difficult process. You simply need to install and use Tor. Go to www.torproject.org and download the Tor Browser Bundle, which contains all the required tools. Run the downloaded file, choose an extraction location, then open the folder and click Start Tor Browser. That's it.”

And what happened to Equifax since the inception of the mess? Big sigh. Sure, executives left or were banished, the company was “tarnished” … but the ultimate punishment plan is still under discussion. See, “Senators want 'massive' fines for data breaches at Equifax and other credit reporting firms” from just a few months ago.

Millennial Housing

So, okay, we made up ways to get millennials to buy houses and no boom resulted! Those brats! Here’s more on that “no boom.” An included quote from Ralph G. DeFranco, Ph.D, global chief economist, Mortgage Services, Arch Capital Services Inc. sums it up by stating:

“With interest rates and home prices both on the rise, first-time homebuyers – largely millennials – may want to consider making the jump from renting to owning sooner rather than late.”

While this topic was a hot one in 2017, interest has waned since then. I, once again, called some of my friends with millennial children still living with them. They all agreed it was still the best option for everyone. Hmmm, perhaps in some ways we’re trying to solve a problem that is not perceived as a problem.

Reverse Mortgages

On that bleak real estate note (we’ll perk it up soon!), let’s move on to something new. What could possibly be new in the reverse mortgage world since this and this?

Lately, I have been seeing articles that are subtly encouraging home owners to use a reverse mortgage to buy a new home. Huh? Here’s how, per bankrate.

“The reverse mortgage typically covers 38 to 71 percent of the new home’s purchase price, says Julie Didyoung, a HECM for Purchase specialist at Reverse Mortgage Funding. The buyer must come up with the rest from the sale of the former home, or from retirement accounts, gift money or savings.”

38 to 71% you ask? That’s a wide range. Here’s how the actual percentage is determined. The factors that are used for the computation are the age of the youngest borrower or non-borrowing spouse; current interest rates; the appraised value of the home; and the MI -- mortgage insurance -- premium. Read more on this topic by clicking:

Here:

https://smartasset.com/mortgage-posts/can-you-use-a-reverse-mortgage-to-buy-a-new-home

Or here:

https://www.kiplinger.com/article/retirement/T037-C000-S004-buy-a-home-with-a-reverse-mortgage.html

Blockchain

Recently, we attempted to ascertain the role Blockchain technology will play in the mortgage business. We had previously given you a primer.

A few days ago, the National Mortgage News posted a well written article, “Opinion Mortgage industry can't afford to fall behind on blockchain.” So it seems everyone agrees on the benefit of using the technology.

The MReport concurs and states,

“Blockchain’s defining elements such as distributed ledgers, smart contracts, inherent security, and digital payments could add efficiency and transparency to the working of the mortgage servicing industry. … Industry thought leaders will address blockchain in mortgage servicing at the inaugural Five Star Fintech Summit in Nashville, Tennessee, on March 21–March 22, 2018.”

And finally, it appears that we’re seeing movement towards blockchain in the mortgage industry. In January of this year, Bloomberg announced,

“Credit Suisse Group AG, U.S. Bancorp, Wells Fargo & Co. and Western Asset Management Co. said Thursday that they successfully tested the distributed ledger technology as a way to standardize the data involved in securitized home loans and make it more transparent.”

Yee haw! And if this topic floats your boat, read more here and let me know if you can read the included chart … tee hee.

https://themortgagereports.com/34467/blockchain-mortgage-the-future-of-home-loans

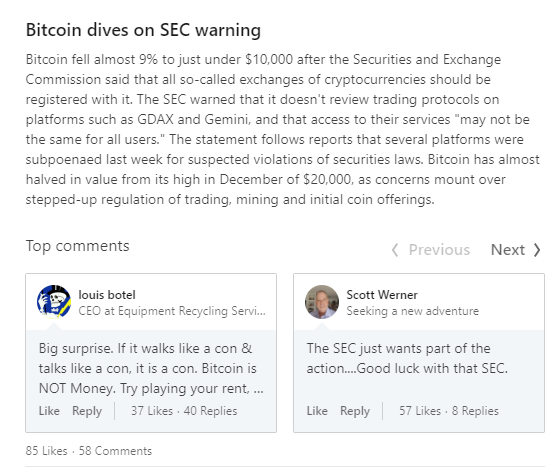

However, blah, blah, blah opinions on the high risk, credibility, and regulation of cryptocurrency still prevail. Check out this pagges I copied directly from LinkedIn a few days ago along with 2 of the (at that time) 58 comments.

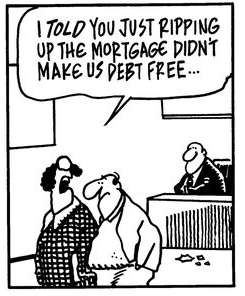

Good grief, you’ve just read pages of scintillating follow up information and there was not a joke to be seen. Time to rectify that!

NOT related to anything in this blog, yet worthy of inclusion, with the requisite following groan expected:

A mathematician wanders back home at 3 a.m. and proceeds to get an earful

from his wife.

“You’re late!” she yells. “You said you’d

be home by 11:45!”

“Actually,” the mathematician replies

coolly, “I said I’d be home by a quarter of 12.”

And one more unrelated quip that also includes a tad bit of profanity (so please do not watch it at work, around children, if you are sensitive, or a critic of the Dollar Shave Club).

https://www.youtube.com/watch?v=ZUG9qYTJMsI&feature=kp

[I don’t watch much TV. Was that ad actually aired on a major channel?]

Now, about that title …

There was a little girl named Fufu.

She went to school one

day and her teacher said, "How do you spell your name?"

The girl replied, "F u f u"

Her teacher sent her to the

principal's office.

She got to the principal's office and

he said, "First off, how do you spell your name?"

She

said, "F u f u "

He said, "YOU ARE SUSPENDED!"

Somewhat related to the title (in that the last word of Kung Fu resembles part of it …), watch this, especially if you like puns and sophomoric humor.

https://www.youtube.com/watch?v=JESCKvARH60

How about a cleaner yet nasty one?

Or, on the flip side ...

And I shall leave you with …

This Just In

http://www.mortgagenewsdaily.com/03142018_millennials_and_homeownership.asp

https://www.housingwire.com/articles/42748-millennials-lead-all-other-generations-in-buying-homes