Crypto Night Mortgage?

It’s all the rage. You cannot click on a news site without seeing something about it. Every industry is scrambling to understand how this should best be used by them. What is it?

Cryptocurrency, Bitcoin, Ethereum, Litecoin, Ripple Currency ...

If you’re an expert on this topic, then here’s a “wow” from me. If not, keep reading as I will now make a feeble attempt to both explain it and speculate on its role in the mortgage industry. Let’s go.

Last year, my brother hosted a mini family reunion. I spent time with one of my nephews who is, literally, a genius. During the conversation, he encouraged me to find uses for ethereum in the mortgage industry. Then he stressed the need to understand Blockchain programming. Little known fact, I was formerly and briefly a computer programmer in Fortran, Assembly Language, Cobol, etc. But Blockchain meant nada to me, zippo. Talk about feeling stupid -- yikes.

While my nephew James is brilliant, he is not the world's best teacher. So even after he explained all of this to me, I still struggled to understand. Obviously then (for me), I needed to … take a class. 🙂 [Don’t be rude; we all have our coping mechanisms.] Udemy offers some inexpensive online options and that's what I chose. If you like the idea but not that class, just click here for additional possibilities. As mentioned, it's all the rage.

All About Blockchain

What is Blockchain? Most often, it is explained in terms of spreadsheets. In other words, picture a million, zillion spreadsheets. Now picture them all duplicated a zillion times over a gabillion networks. And watch this happening “real time” live. Also, understand that the data is always verified and public and accessible. Blockchain makes a third-party intermediary unnecessary and also adds anonymity. Therefore, it is extremely difficult to hack this data as it is updated, verified, spread, … constantly. (Or so we’ve been told, but not by the likes of Guccifer!)

If that above explanation is not clear, try these sources: Blockgeek’s “What is Blockchain Technology? A Step-by-Step Guide For Beginners”; or Computerworld’s, “What is blockchain? The most disruptive tech in decades”; or as posted on LinkedIn, “Blockchain 101.”

Bitcoin, Ethereum, and Litecoin are all written using Blockchain programming. Why are there many different cryptocurrencies (for now)? How are they similar and how are they different?

Not to worry. CNET has a primer that explains many of those differences for three of them. It’s called, “Bitcoin, Ethereum or Litecoin.”

Cryptocurrency - Always Changing, Always Interesting

Here’s what is also interesting to know. Digital currency Bitcoin is used in many places already-- online vendors, hotels, some restaurants, etc. Ethereum has some big name investors associated with it. Litecoin is known and used less -- today. And there are many others also, like Ripple. Check Investopedia’s list or these 7 highlighted in Market Watch or just review the (literally) 33,900,000 other Google discussions on this topic. Wow! Talk about trending. But that’s not even the newsiest part of it lately...

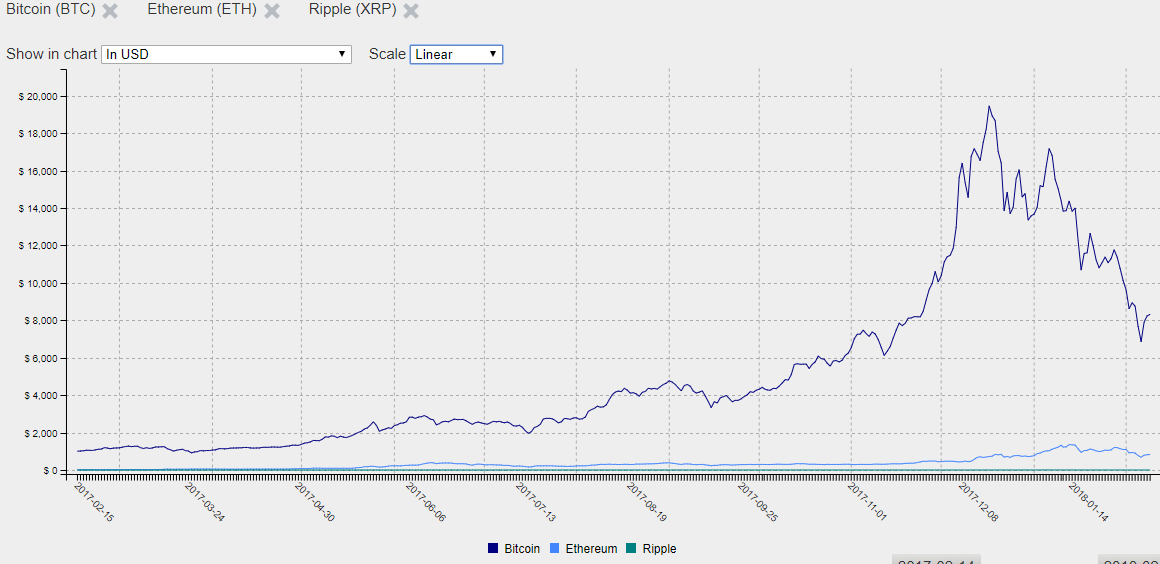

Lately, cryptocurrency stock has been volatile, to put it mildly. JUST for the visual, check this graphic from cryptocurrency chart and note that, by the time you read this, that chart could be completely and totally changed by a power of 2, 3, 5, who knows!

It's too small to decipher here, so I’ll tell you that the chart represents less than one year and what started at about $1500 got as high as nearly $20,000. Yes, that’s volatile.

Now you have a complete and clear understanding of cryptocurrency, right? Okay, so maybe you kind of sort of get it a little bit. Wherever you lie in that continuum, let’s focus on how Blockchain and cryptocurrency can assist the good old mortgage industry.

The New Kid on the Block

It’s no surprise that HousingWire beat me to it months ago. In “Mortgage lenders: Here's your blockchain primer,” they note that:

“One of the most exciting features of blockchain from a legal and compliance perspective is its “immutability”, meaning that as soon as transactions are recorded into the blockchain ledger, they cannot be altered or deleted. Blockchain has the potential to further strengthen compliance and audit by demonstrating a secure chain-of-custody for the transfer of any digital asset (e.g., secured loan or lease) to anyone that has permission on the network.”

Further, all aspects of the loan process would be open and transparent. Transactions could be executed immediately versus in days or weeks. Costs could ultimately be reduced significantly. And that last item might just be the one that sparks new technology adoption faster than ever seen before.

How much savings? Here’s an estimate from Nasdaq in, “How Blockchains Can Disrupt the Mortgage Market.”

“Consumers could potentially expect savings of $480 to $960 per loan and banks would be able to cut costs in the range of $3 billion to $11 billion annually by lowering processing costs in the origination process in the U.S. and European markets.”

One relatively funny note before we power forward … I started a search for Bitcoin and the mortgage industry to see what was available to add to this article. I did not expect to find these.

People are putting their homes at risk to buy Bitcoin

People are taking out mortgages to buy bitcoin, says securities regulator

Don't Take Out a Second Mortgage to Buy Bitcoin

And then there was this:

Will Bitcoin replace mortgage lenders?

What?? Let’s veer over to the funside here! We can start with these:

Vegas developer selling $7.85M mansion for bitcoin and Buy this $8M mansion with bitcoins

But I was unable to determine if the sales happened with or without Bitcoin. But here’s one that recently sold:

“Bitcoin-like cryptocurrency used to buy home in Tukwila, likely a first for Seattle-area market”

So what’s it all about Alfie? Good grief, I’m sorry.

Anyway, it's all about NEW technology and THAT is exciting. The programming code-- Blockchain -- has started numerous digital currencies such as Bitcoin, Ethereum, etc. But Blockchain on its own may revolutionize not only the mortgage industry but also 5 other industries, no, no, make that 19 industries or more!! If you're also in the mortgage biz (or any of those 19 other industries), it might just be time to go CRYPTO -- in secret or not.

Knock Knock Jokes Block Block Jokes

I normally end all of these with an attempt at humor (and shame, shame on you who open and scroll right to the end!). So when I searched for Blockchain or Bitcoin or Ethereum or … related humor, I was shocked to see page after page of possibilities. However, I am sad to report, I understood only about 2% of it all, ha. Then there were some that just didn't seem funny (due, no doubt, to my lack of in depth knowledge). For example:

A boy asked his bitcoin-investing dad for 1 bitcoin for his

birthday.

Dad: What? $15,554???

$14,354 is a lot of money! What do you need $16,782 for

anyway?

Yes, I get it -- constant and immediate price volatility. But that didn't make me laugh (and isn’t it shocking that I actually have humor standards!)

So what about this one?

But hope prevails and I found some that John Q Public and I can enjoy as much as Dorian Prentice Satoshi Nakamoto, credited with maybe being the founder of Bitcoin. What do you think?

What’s the difference between bitcoin and marriage?

You only lose the house, kids, and half your wealth when

your marriage fails.

~~~

Why does Superman hate trading Bitcoin after 7pm?

Because it's Crypto-night

~~~

In related news:

Crypto-currency craze 'hinders search for alien life’

Not to be confused with Cryto Kitties

Or, Salon asks ad-blocking users to opt into cryptocurrency mining instead

Embrace new technology!