When looking at the terms of a mortgage, you’ll normally see a loan amount, the length of the mortgage, the down payment, the interest rate, and the APR. You may also see an estimated monthly mortgage payment and the amount of closings costs or fees. Most of these terms are easy to understand – the length of the mortgage is how long you’ll be repaying the loan, the down payment is the money you’ll pay (or “put down”) at closing and is a percentage of the loan, and the interest rate is how much interest you’ll pay on top of repaying your loan amount. However, what exactly is the APR? And why is it sometimes higher than the interest rate? How does it fit in with everything else? Read on to find out!

What it Means

APR is short for “annual percentage rate.” Your interest rate will affect your APR, but the APR is also affected by any fees you have associated with your loan. It’s essentially the yearly rate of the costs of your mortgage. Because it includes the additional payments and fees associated with your loan, the APR is very important when planning a budget and trying to figure out what type of mortgage you can afford.

Why Is It There?

You may be wondering why the APR is included as a separate number – why don’t banks simply have the interest rate and then the fees and costs associated with the loan next to it? There’s actually a law that requires them to list the APR. The Federal Truth in Lending Act, which is designed to protect borrowers by requiring disclosures with important information, states that if a mortgage lender lists any “trigger terms” (such as an interest rate), all of the terms that affected that rate must be listed (such as term length, down payment, and APR). This is to prevent unethical lenders from advertising an extremely low interest rate, only to later charge borrowers an excessive amount of fees.

How is APR Calculated?

APR is calculated using your monthly mortgage payment, the number of payments you’ll make, the fees associated with your loan, and your loan amount. The actual formula is more complicated, but you can use mortgage calculators (or even some spreadsheet programs) to calculate APR.

Does it Affect my Mortgage Payment?

Does the APR affect your mortgage payment? Yes and no. APR isn’t used to calculate your mortgage payment, but since it does show the total costs of your loan, it’s meant to give you a better sense of how much you’ll pay overall. For this reason, it’s important to consider both your mortgage payment AND your APR when comparing mortgage options – don’t ignore one to focus on the other!

Fees and Thank You

Not all fees may be included in the APR – it’s always important to ask for a cost breakdown! Here is a list, taken from Mortgage Coach, that shows which fees are normally included or not included when calculating the APR:

Normally included:

Points

Pre-paid interest

Admin Fee

Loan-processing fee

Underwriting fee

Document-preparation fee

Private mortgage-insurance

Escrow/Settlement fee

May or may not be included:

Loan-application fee

Credit life insurance

Normally not included:

Title or abstract fee

Attorney fee

Notary fee

Document preparation

Home-inspection fees

Recording fee

Transfer taxes

Credit report

Appraisal fee

Tips on Understanding APR

Say you have two different loan options, and one has a lower APR. Does that mean you should automatically go with that loan? Well, not exactly.

APR is very useful when trying to pick a mortgage, since it gives you a more accurate cost than just the interest rate, but you still want to consider all the other factors that go in to your mortgage. The APR may not include all the costs associated with your loan; be sure to look at a breakdown of the costs and fees. Different types of loans can also affect the APR; for adjustable rate mortgages, the APR usually doesn’t express the maximum potential interest rate, which means even if it’s accurate now, it could be higher in the future. It’s important to understand APR before choosing a loan, but be aware of the other factors that you need to consider.

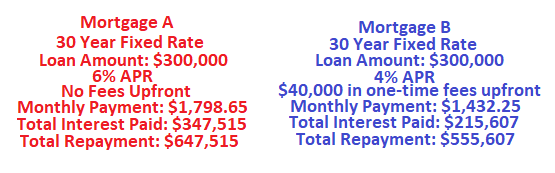

You should also consider your future goals and long-term plans for the mortgage. It may make sense to have a higher APR with less fees if you're going to be selling your home before the loan term is over. If you plan on staying in your home for the duration of the loan term, getting a lower APR may save you money even if there are more fees associated with it. NerdWallet gives the following example:

As you can see, paying the $40,000 in fees upfront for Mortgage B resulted in saving a total of $91,908. However, if you only lived in this house for four years, you won't see the same savings - the 4% APR plus the $40,000 one-time fee means that you would have paid $16,109 more than if you had avoided the fee and opted for 6% APR. The key is to find the "break-even" point and figure out whether you are likely to move before or after.

Final Takeaways

So we’ve gone over APR, which is the rate that shows the yearly cost of your mortgage and includes the interest rate plus fees and other costs. Hopefully you understand it a bit better now, but what else should you look at when comparing mortgages?

Obviously both the APR and the interest rate are important, but when comparing mortgage options, you should never compare the interest rate of one mortgage to the APR of a different mortgage. Always compare interest rates with other interest rates, and APRs with other APRs (comparing an interest rate to an APR is like comparing an apple to an orange – you only want to compare apples to apples). Also remember to look at the specific fees that are included in the APR, as well as the fees that aren’t. Make sure you know what the monthly mortgage payment will be, the type of the loan, and the loan term. Also consider your future, and whether you might be likely to move and sell the house. Comparing all these factors can help you find the mortgage that’s best for you.

Ready to view mortgage rates? You can use RateZip to compare different lenders, or read up to learn more information!